Pay attention to the lunatic drawing on the board. This is an attempt to illustrate that in a highly non-linear coupled, complex system, small perturbations can lead to large scale changes in the system (or system collapse).

In this case, the collapse/crises is facilitated by the artificial escalation of non-physical assets (virtual assets) and the subsequent exponential increase in the trading of these virtual assets.

When something happens to the value of the virtual assets, a chaotic wave is then generated that cascades throughout the entire system.

The end result is that the amount of "capital" that there is to "borrow" is now greatly reduced and this strongly threatens future needed investments.

In the context of this class, the bottom line is that the current financial crises makes it even more difficult for the private sector to be part of the solution. Thus we have to rely more on government policies.

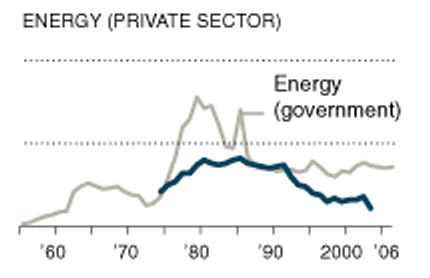

Wave form of our investment - top dotted line is 10 Billion, middle dotted line is 5 B.

In 2006 combined investments in Energy Research and development were about 10 Billion dollars, compared to about 85 Billion for military related research and development --> although there is some energy related applications that are being done under military research: specifically improved battery energy density storage and alternative fuels.

>

>